AlixPartners, a leading global business advisory firm, recently published the North American Restaurant and Foodservice 2016 Outlook port entitled, “Tall Orders: Higher Wages and Menu Changes”. The report included some very interesting findings.

The US food industry has managed to bring in front some great results in 2015 all thanks to some macroeconomic factors. The consumer sentiment is higher and the food commodity pricing is kept lower than what it was a year ago. There are some challenges that seem to appear such as international crisis and oil pricing issues that might shift the performance of this industry in the near future.

How are the prices shifting?

An important thing to note is the basket of food pricing is up to 15% lower than it was in 2014 and the trend continues to shift. It’s all thanks to a decline in meat based products and wheat, not to mention the gasoline prices have also dropped the past few years as well.

According to the report, while the number of restaurant units is down from the 2013 peak, per capita spending has continued to increase year over year and we can expect the trend to continue in 2016 but also moving forward.

Top Consumer Priorities

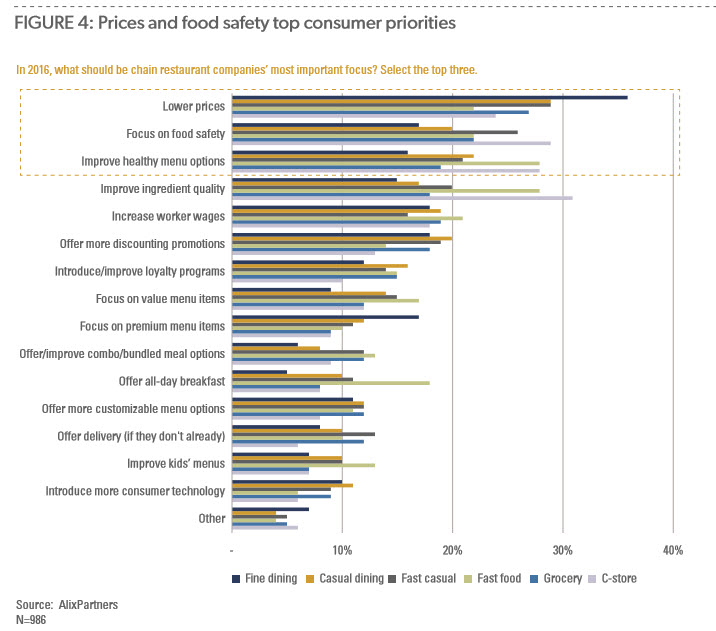

The top consumer priorities are detailed in a chart on page 5 of the report. Alix Partners points out that the top priorties are:

– Lower prices, food safety, healthy menu options, and ingredient quality are top priorities across most segments.

– Lower prices most important for full service, fast casual, and grocery.

– Introducing more consumer technology is a low-ranked priority across the industry.

The report goes on to make the following observations about discounting as we move into 2016. These observations are taken directly from the report.

- There appears to be an especially renewed focus on discounting within the quick service-restaurant (QSR) segment, although the casual-dining segment seems to have pulled back from buy-one-get-one offers, coupons, and low-cost strategies in favor of a focus on increasingly health-conscious, quality-oriented consumers.

- Meanwhile, about 56% of consumers said they plan to seek out more discounts in 2016 than they did in 2015. Planned use of coupons, promotions, and discounts specifically to cut restaurant spending climbed to 39% from 36% the previous year.

- Almost 60% of consumers said they’re most likely to use coupons or discounts if the coupons or discounts are from establishments they visit frequently, and 31% said receiving one big offer less frequently (such as a free entrée) would most likely entice them to respond.

- Only 16% of customers said they’re most likely to use a discount offer or coupon if it’s from a restaurant they know but have never visited.

- Consumers also said they’re more likely to respond to a discount or offer that comes in the mail or by e-mail, with 26% of respondents indicating each of those modes of communication is important.

Mobile delivery and online delivery seem less important, with 15% and 13% response rates, respectively.

Getting customers to try your restaurant

An interesting point from this report is that only 16% from the consumers want to try out discounts for the new restaurants. This is helpful information when targeting new customers with advertising to get them to try your restaurant. Even with a strong offer you can expect a relatively low response rate.

Technology

Page 9 of the report looks at technology and consumers priorities. Again, taken directly from the report:

- Consumers still said restaurant operators’ most important technology offerings are digital menus and online ordering, with each getting a top-priority rating of 54%.

- Digital menus and online ordering are far ahead of mobile functionality and tablets or ordering kiosks—features that diners listed at 32% and 38%, respectively. However, digital loyalty programs remain a high priority, registering as a close third to digital menus and online ordering, with a 52% response rate.

- What’s interesting here is that despite digital loyalty’s ranking so high, only 14% of respondents said loyalty programs are very influential or extremely influential in their choice of restaurant.

My Concluding Thoughts

I believe that consumers that are interested in coupon offers want it to be as easy as possible to take advantage of discounts. But what the report suggests with the relatively low ranking of digital loyalty programs is consumers are not that loyal and can’t be bothered with multiple loyalty apps on their phones.

Restaurants are caught in the dilemma of making it too easy to give discounts to customers that the consumer did not know about or do not care about discounts when making a purchase. In both cases giving away needless discounts only to reduce overall profitability.